I can’t remember if I told you about this cool project that Consult Hyperion has been helping out with over the last year or so. One of our very favourite clients, Barclaycard, decided to exploit the Host Card Emulation (HCE) technology in Android mobile phones and make a payment app so that customers could pay with their phones at any of the 300,000+ contactless terminals in the UK.

Barclaycard is set to become the first financial services provider in the UK to introduce contactless payments from any NFC enabled Android phone via its app

[From Mobile App Transforms Android Phones | News | Home.Barclaycard]

Well, they started rolling it out to customers, and it’s great. It’s the Barclaycard Contactless Mobile app, and it has some interesting features that you should know about.

-

While the contactless limit in the UK is £30, with the Barclaycard app you can perform transactions up to £100 by entering you card PIN on the phone.

-

The app works with Transport for London (TfL) so you can use it to ride the bus and get on the tube.

-

Customers can choose to have “PIN to Pay” on, in which case you have to enter your PIN before all retail payments, even below £30 (except at TfL gates – even with “PIN to Pay” you can just tap and ride).

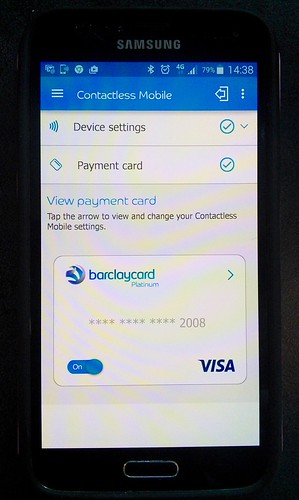

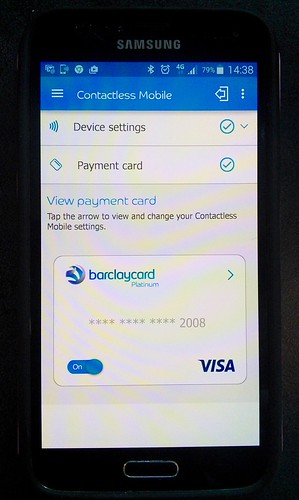

It’s been designed to be very simple to use, just a single card enabled at any time (no card clash!) and just requires the screen backlight to be on to work for payment. Here’s what it looks like.

You can choose between your cards and select the one that you want to be active.

And here’s our very own Matt Barker using the app to buy an actual coffee. When you try the app, you’ll be surprised by how fast and convenient it is.

And just to prove it – here’s the receipt.

One of the features I rather like is that they have a real-time replacement service.

Barclaycard customers will be able to use the host card emulation (HCE) function being added to the bank’s app to have lost or stolen plastic cards instantly re-issued to their mobile devices

[From Barclaycard to use HCE to instantly replace lost and stolen cards • NFC World+]

So well done to all the team up at Barclaycard. It’s a great app, and it works really well, and I’m genuinely not just saying that because we helped out. I said from the beginning that HCE would make for some interesting developments. Remember this, from a couple of years ago?

Visa’s support for cloud-based payments follows the introduction of a new feature in the Android mobile operating system called Host Card Emulation (HCE); HCE allows any NFC application on an Android device to emulate a smart card, letting users wave-to-pay with their smartphones, while permitting financial institutions to host payment accounts in a secure, virtual cloud.

[From Visa to Enable Secure, Cloud-Based Mobile Payments | Business Wire]

Now, as we said about it at the time, HCE was an earthquake. It shifted the tectonic plates (the banks, the schemes, the mobile operators, the retailers in my clumsy metaphor) and created new fault lines between them. It’s not as if we were the only people that noticed. Again, from a couple of years ago.

According to Visa head of Digital Solutions for Developed Markets Sam Shrauger, the new cloud-based implementation of its payWave service will free up the NFC payments from a few specialty digital wallets, allowing any developer to embed point-of-sale payment options into their apps.

[From Visa, Mastercard just made it much easier to buy stuff with an Android phone — Tech News and Analysis]

Sam was spot on. Anyone can use HCE to add payments to apps for retailers. But as we’ve seen since that “KitKat” announcement, organisations can also use HCE to add loyalty, ticketing, travel, coupons, access control and all sorts of other fun stuff to their apps! So if you want to take your Android app and figure out how to add secure, reliable tap-and-go magic, give us a call!